Performance Overview and Earnings Forecast

Please summarize earnings results for the fiscal year ended March 31, 2021.

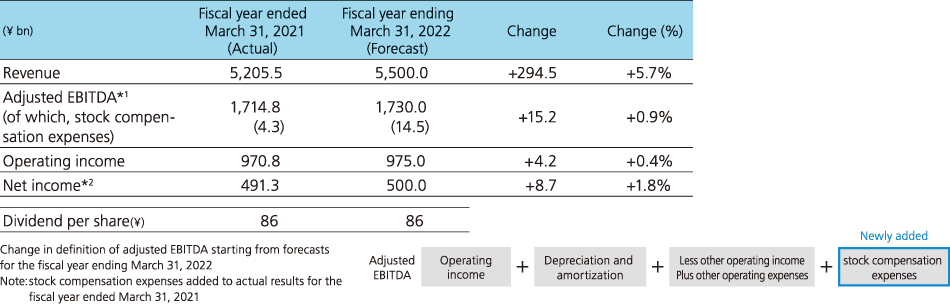

For the fiscal year ended March 31, 2021, revenue increased by 7.1% year on year to ¥5,205.5 billion, operating income grew 6.5% year on year to ¥970.8 billion, and net income attributable to owners of the Company rose 3.8% year on year to ¥491.3 billion. With the entire world completely caught up in the outbreak of COVID-19, we initially projected a rather harsh scenario for earnings and thus tried to come up with a contingency plan to maintain growth of revenue and income. Ultimately, we raised our earnings forecasts during the fiscal year, and all business segments recorded increases in revenue and operating income for three consecutive fiscal years.

I believe this result comes from not only steady progress made on the Beyond Carrier strategy as the digitalization of society continues to accelerate its pace, but also from our constant effort in forecasting challenging scenarios and re-examining our productivity and cost cutting measures.

Are you able to continue to achieve increases in revenue and income for the fiscal year ending March 31, 2022?

For the fiscal year ending March 31, 2022, we have set our sights on four consecutive fiscal years of revenue and income growth and a consolidated operating income target of ¥975 billion. We aim to achieve this by offsetting the negative impact from mobile service plan reduction with thoroughgoing cost cuts, including the ones achieved by group synergies, in addition to growth in the Enterprise and the Yahoo! JAPAN/LINE segments. With the trend we have seen until now, it would be unsurprising if we were to achieve our operating income target of ¥1 trillion for the fiscal year ending March 31, 2023 one year ahead of schedule, but for the fiscal year ending March 31, 2022, we have already started out with the negative impact of more than ¥100 billion owing to mobile service price plan reduction of ¥70 billion and amortization of intangible assets associated with the business integration with LINE of ¥30 billion. We think the headwinds in the Consumer segment are pushing us in the direction of accelerated growth in non-telecom businesses. We will therefore navigate our way towards four consecutive fiscal years of revenue and income growth.

- [Notes]

- *1Adjusted EBITDA = operating income + depreciation and amortization (including loss on disposal of non-current assets) + stock compensation expenses ± other adjustments

- *2Net income attributable to owners of the Company

Cost Strategy

What kind of approach do you intend to take to realize your policy “keep the costs flat”?

Whilst we intend to aggressively invest in 5G base stations, we are also developing new business fields one after the other. If we launch a new business, it will naturally require management resources, but rather than procuring the necessary resources externally, our basic policy is to first find a way of raising them within the Group so that we might keep fixed costs to a certain level. Because it is logical that we will achieve growth in revenue and income if we keep fixed costs flat while driving up revenue continuously.

Keeping costs flat is not through laying off employees or making performance based adjustment. In order to raise internal management or financial resources, for instance, we are pushing ahead with efforts to reassign personnel to improve operational efficiency, reduce costs through joint procurement, and bring operations in-house with the effective utilization of the Group resources. Instead of curtailing costs, we are more focused on generating internal funds for growth.

Also, in the fiscal year ended March 31, 2021 we moved our corporate headquarters to Takeshiba. The benefits from the fixed cost reductions stemming from this move will start to materialize from next fiscal year. Given the rapid adoption of teleworking, we chose to roughly halve our office space with the relocation of our corporate headquarters, and the state-of-the-art smart building also serves as a testing ground for digital solutions. We expect the new headquarters to not only reduce costs, but also positively impact the topline growth.

Shareholder Returns

Have you made any changes to SoftBank’s high shareholder return policy?

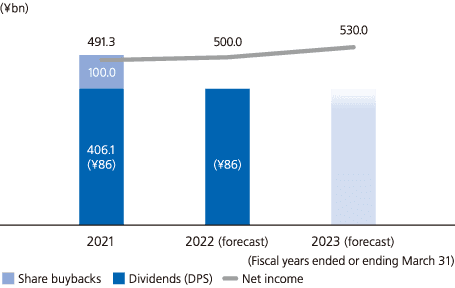

Our policy of achieving both growth and shareholder returns ever since the Company’s listing remains the same. For the fiscal year ended March 31, 2021 we paid an annual dividend per share of ¥86, an increase of ¥1 year on year. Total dividend payments came to ¥406.1 billion. We also carried out share buybacks of ¥100.0 billion. From the fiscal year ended March 31, 2021 to the fiscal year ending March 31, 2023 we aim to maintain a total shareholder return ratio of approximately 85% (three-year weighted average) without reducing dividends and plan to continually implement flexible share buybacks.

Being able to undertake business development with high investment efficiency and minimal funds thanks to collaborative efforts with our parent company, SoftBank Group Corp., and its investee companies enable us to achieve both high shareholder returns and investments for growth.

However, I do not believe the growth potential of our diverse businesses has been fully reflected in the Company’s share price. So I think we need to strengthen initiatives that focus on total shareholder return (TSR) as a measure of management performance that also reflects share price, in addition to dividends. To that end, starting in the fiscal year ending March 31, 2022, some components of officer remuneration will be linked to TSR.

Cash Allocation

What are the indicators that you focus on in order to achieve both growth and shareholder returns?

We focus on adjusted free cash flow (FCF), which is calculated by operating cash flow, less capital expenditures and investments for growth. In particular, because we have made it publicly open that we do not intend to reduce dividends, we consider our baseline to be FCF of ¥100 billion after dividend payments—in other words, the baseline to be adjusted FCF less the scheduled dividend payments. We calculate backwards from there to establish an adjusted FCF target and also control annual expenditures.

For the fiscal year ended March 31, 2021 we set an adjusted FCF target of ¥670.0 billion, which we achieved 107%. As a result, FCF after dividend payments recorded ¥183.9 billion which was higher than ¥100 billion. We used the remaining free cash to carry out the share acquisition of LINE and the share buybacks. Following the Company’s listing, we made some big investments, including the consolidation of Yahoo Japan and the share acquisition of LINE. In terms of investments for growth other than these large-scale strategic investments, we have a budget of around ¥50–¥70 billion each fiscal year to draw on to seed new businesses.

When we execute investments, we focus on the internal rate of return (IRR) as the hurdle rate. Our weighted average cost of capital (WACC) for the fiscal year ended March 31, 2021 was roughly 5%, and we have set the hurdle rate well above the WACC and execute investments on the condition of clearing that rate.

Financial Soundness

Raising capital is a key to investments for growth. How do you approach the fund-raising and what indicator do you emphasize in ensuring financial soundness?

Considering that we are blessed with growth opportunities, if we are to continue high shareholder returns whilst actively investing in businesses, I believe we must make use of debt, cost of which is lower than equity, to manage business operations with a certain amount of financial leverage.

That is why we emphasize on the net leverage ratio—the ratio of net interest-bearing debt to adjusted EBITDA—as an indicator for monitoring financial soundness in light of a balance with our earnings capacity, and we control it in 2.0x–3.0x range. Our net leverage ratio at the end of March 2021 was 2.3x. We currently have long-term debt ratings of A+ and AA− with Rating and Investment Information, Inc. (R&I) and Japan Credit Rating Agency, Ltd. (JCR), respectively. The average net leverage ratio at companies that have the same ratings as ours is around 2.6x. Considering that our shareholders’ equity ratio is relatively low, we consider a net leverage ratio of 2.4x or less to be an appropriate level. Going forward, we will aim to bring it closer to 2.0x level.

- [Notes]

- *1Net leverage ratio = Net interest-bearing debt / Adjusted EBITDA (LTM)

- *2LTM EBITDA of ZOZO retrospectively adjusted for FY19Q3, FY19Q4, FY20Q1 and FY20Q2

- *3LTM EBITDA of LINE retrospectively adjusted for FY20Q4

As for the fund-raising, at the time of our public listing we primarily relied on indirect financing such as bank loans. Since going public we have increased direct financing mainly through bond issuances, which helps stabilize our financial base and improve financing costs. We intend to increase our total bond issuance by more than ¥100 billion every year. As we have made company-wide efforts to contribute to the Sustainable Development Goals (SDGs) since the fiscal year ended March 31, 2020, we want to issue ESG bonds.

Group Governance

SoftBank’s parent company is also a listed company, as are multiple group companies. What is your view on the parent company and its subsidiary both listed on the stock exchange?

I think publicly listed companies have the advantage of being able to strengthen themselves as a result of engaging in independent management and bearing more responsibility. We took the bold decision to consolidate Yahoo Japan (currently Z Holdings) in June 2019 and established PayPay Corporation together with Z Holdings for the purpose of building mainstay businesses for the future after discussing the best way to grow the Company after our listing. I think the fact that PayPay Corporation has grown so much since its establishment owes not just to its position as a fellow subsidiary under the umbrella of the same parent company (SoftBank Group Corp.) but to the fact that we made it our very own project.

As for my view on listed subsidiaries, SoftBank emphasizes on service neutrality. In other words, whether it be Yahoo! JAPAN or LINE under the management of Z Holdings, or PayPay, we want to transform them into universal services that the entire population of Japan would use, not just as services only for users of SoftBank smartphones. From this point of view, it may be better off for our subsidiaries not to be wholly-owned subsidiaries of SoftBank. Our basic premise is not to damage the interests of minority shareholders of the listed group subsidiaries. Based on this premise, I think we can mutually achieve considerable growth by leveraging the synergies between SoftBank and the listed subsidiaries that provide industry-leading services, and thereby forging win-win relationships for all parties.

SoftBank’s capital structure is getting more complex as the Company diversifies its business operations and adds more group companies. Are there any issues with the governance?

In 2015 there were 27 group companies (subsidiaries and affiliates), and in only five years, this number rose to 335. Each company is in a different situation; some of them are publicly listed, such as Z Holdings and SB Technology Corp., while others are still at the startup stage, and some are posting strong earnings, while others need to improve performance. Instead of centrally managing all of them side by side, it is getting important to decentralize control with the use of core group companies like Z Holdings to function as hubs. Accordingly, during the fiscal year ended March 31, 2021, we set about task to organize and structure as to which companies should be hubs that directly manage others and what level of hierarchy should be applied to each group companies. We continue to carry out this task with the aim of enhancing the effectiveness of the group governance from the fiscal year ending March 31, 2022 under this organized management structure.

Showing Business Value

Some are saying that the overall picture of the Group has become unclear because of the diversified business lines such as Z Holdings and PayPay Corporation. What do you think of the impact on the share price?

The Company boasts a lineup of prominent subsidiaries and affiliates with an overwhelming presence and is enhancing its ability to create and monetize new businesses in various fields. Meanwhile, Some people suggest that the overall picture of the Group has become difficult to understand compared with what it was when we were predominately a telecommunications carrier as we continue to drive forward our Beyond Carrier strategy. We are responding to this suggestion in a serious manner. I know that the overall value of the Group is unlikely to be reflected in our share price unless the market has a proper understanding of it.

The Company’s shares are often valuated with an EV/EBITDA multiple and P/E ratio, common stock valuation methods for telecommunications carriers, or with an indicator such as dividend yield. However, we boast an immense variety of growth opportunities because we possess growth drivers such as Yahoo Japan, LINE, and PayPay Corporation. For that reason, I would like a valuation with the SOTP (sum-of-the-parts) method, a valuation model that combines the value of each business as a whole that harbors enormous growth potential, instead of a valuation based on the consolidated financial data of the Company just as a telecommunications carrier.

Accordingly, information disclosure is a key for the aggregate value of our diverse businesses to be accurately reflected in the share price, and it is important for us to engage in dialogue with the capital markets to find out whether the potential values of our businesses is being factored into valuation models. Discussions based on concrete figures are beneficial to the facilitation of substantive dialogue. For example, for the fiscal year ended March 31, 2021 we ventured to disclose the gross merchandise value (GMV) for PayPay Corporation, which was still in the upfront investment stage. Information on the annual GMV of ¥3.2 trillion provided an indication of the size of the business, and, considering that the annual personal consumption in Japan amounts to around ¥300 trillion, the disclosure conveyed the message that the business still has plenty of room for growth. Even though PayPay Corporation does not seek for a business that makes profits solely from payment fees, I would like the market to recognize that, at the very least, turning into profit is achievable.

We strongly hope that the market evaluates what we consider to be our true corporate value and that it will be accurately reflected in the share price. That is why we decided to disclose operating income forecasts by segment for the first time along with figures for PayPay Corporation and other leading subsidiaries. Going forward, our policy is to further enhance the information disclosure.

Role of the CFO

Finally, what do you think of your role as CFO?

I believe the CFO plays a role as a compass for the company that accurately navigates the way forward. Accordingly, first, I will decide on the mountain to climb, in other words, a company-wide goal. After deciding on the mountain to climb, instead of making a mad dash for its summit, I will shed light on where we are currently standing, in other words, gaps between our standing point and that goal. Then I will discuss with others whether our preparations have been enough to climb on the top of the mountain and what our next move should be in order to advance. Sometimes, I play the role as an guardian angel to ensure that the Company does not go down an overly risky path. As CFO, I strongly hope to work continually towards meeting the expectations of our stakeholders.