We are aiming further growth

by promoting the widespread

use of cashless payments

and expanding financial services

PayPay Corporation

President & Representative Director,

CEO, Corporate Officer

Ichiro Nakayama

Joined International Digital Communications Inc. (now IDC Frontier Inc.)

in April 1994. Appointed President & Representative Director in April 2013.

Appointed Director and Executive Vice President of Ikkyu Corporation

in March 2016. Assumed current position in June 2018.

Service Overview

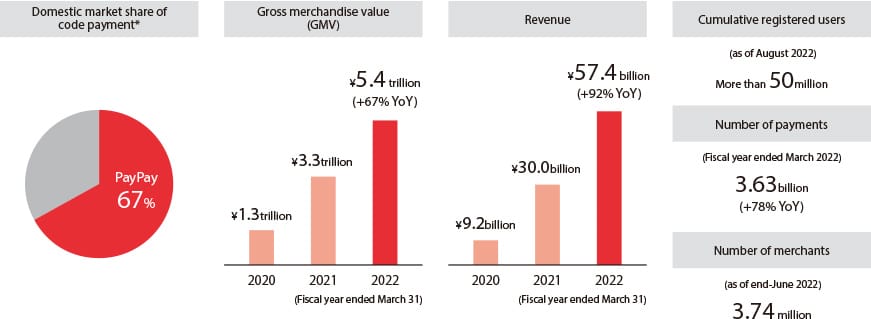

With more than 50 million registered users as of August 2022, “PayPay” is one of the Japan's largest cashless payment services. Starting with the payment service, PayPay also provides various services for users, including financial services, as well as various services for merchants.

Establishment Background

PayPay was established in 2018 by combining SoftBank's sales force and Yahoo's development capabilities, with technical support from Paytm, a global cashless payment provider that is a portfolio company of a fund invested by SoftBank Group Corp.

At a Glance

- [Note]

-

- *Ratio of PayPay gross merchandise value (2021) as a percentage of total merchandise transaction value in the code-based payment market. Calculated by the Company based on the “Survey on Code Payment Usage Trends, June 5, 2022,” published by the Council for the Promotion of Cashless Society.

Potential of “PayPay”, now one of Japan's largest cashless payment services

“PayPay” has grown to become one of the Japan's largest cashless payment services, currently used by more than half of all smartphone users. As I have been president of PayPay since its establishment in 2018, it is really pleasing that “PayPay”—a latecomer to the code-based payment service market—is now in such a strong position. That said, if I were to ask myself whether we should be content with our current position, I think the answer would be, in a positive sense, “not yet.” Given that total annual personal consumption in Japan is approximately ¥300 trillion, PayPay's gross merchandise value (GMV) of ¥5.4 trillion in the fiscal year ended March 31, 2022 represents a share of less than 2%. Our aim is to shake up cash-based spending in Japan, which is said to be approximately ¥200 trillion. If we see this as our TAM*, then there is still a huge market in front of us. I believe there is no other business in Japan with such a large TAM.

- [Note]

-

- *Total addressable market: Largest possible market size that can be acquired.

Continuing to hone our three strengths and providing services supported by both users and merchants

In order to win in this vast market, gaining the support of both users and merchants is essential. To this end, the strengths that "PayPay" continues to hone are its development, sales and marketing capabilities.

As for development capability, we have insisted on in-house application development since the company's inception and have continually enhanced security while quickly responding to changing user needs. We have highly skilled engineers from about 40 countries and regions, and we conduct development 24 hours a day leveraging time differences. In addition to speedy development, we are particular about the stable operation of our settlement infrastructure, as we have recently started to process hundreds of billions of yen per month. As we are now able to achieve both speed and stable operation, we are proud to say that our development capability has been further enhanced.

As for sales capability, we onboarded SoftBank's best sales force from the start-up period, with several thousand sales staff directly visiting stores to undertake in-depth sales activities, ranging from new merchant signups to after-sales support services. As a result, we have a merchant network of more than 3.74 million locations, including not only convenience stores and large chain stores, but also small and medium-sized independent stores. For merchants to realize the benefits of adopting “PayPay”, we are strengthening our sales capability by enabling our sales employees to show with figures that the number of customers visiting stores has increased, and that the unit price per payment and frequency of visits to stores have risen.

As for marketing capability, we have been implementing effective campaigns that match the phase of the business. Since “PayPay” launched as a latecomer to the code payment service market, we conducted large-scale marketing campaigns such as “10 Billion Yen Giveaway Campaign” to rapidly increase our visibility. Currently, alongside mass marketing, we undertake personalized marketing to communicate the most appropriate message based on the interests, tastes, and behavioral patterns of each user. It is not so flashy that it hardly becomes a public topic, but we are further developing our “marketing capabilities” so that we can market more efficiently for different purposes, such as uncovering dormant users and increasing the unit price of payment.

Aiming growth with a three-layered revenue model

At first, we have been operating our business with the hope of making “PayPay” referred to as the very cashless payment service. However, simply being a payment app is not our ultimate goal. We want “PayPay” to be a super app that can be used anytime and anywhere, that enriches and makes life more convenient. We want to hear people say that their everyday life is way more convenient with "PayPay".

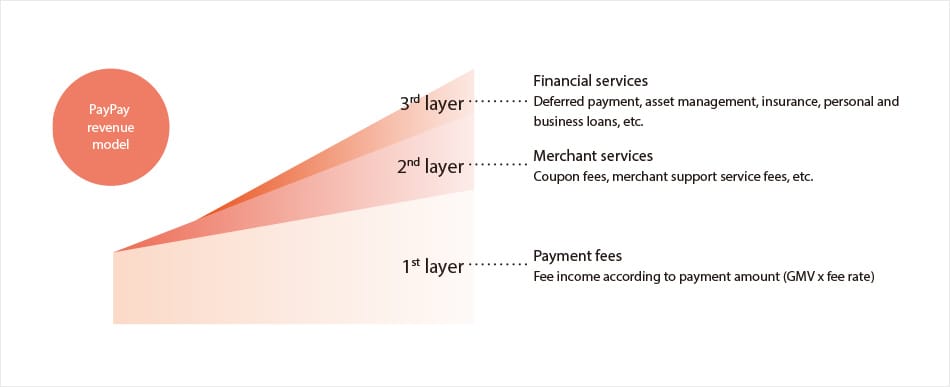

Guided by this vision, we intend to grow the app's services based on a three-layered revenue model. This model comprises payment fee income on the first layer, merchant services on the second layer, and financial services on the third layer.

Payment fee income increases in line with growth in GMV. Thus, to expand the first layer, it is important to increase the use of “PayPay” in more situations. If there is a situation in which “PayPay” is currently not being used, it means that there are other payment methods more suitable for that situation. We have thoroughly analyze such use scenarios and are continuously improving the functionality of “PayPay” to make it the first choice for payment in all aspects of our lives. As I mentioned earlier, because cash-based spending in Japan amounts to approximately ¥200 trillion, we think there is still plenty of room for growth in payment fee income up ahead.

For merchant services, we collect service fees from merchants by developing and providing marketing solutions that drive their sales growth. More specifically, we offer “PayPay My Store”, a monthly flat-rate service that supports merchant management as well as coupon services to attract users to their stores, and stamp services to increase repeat customers. If merchants are able to boost sales with the use of these services, it also means more payment fee income and service fees for PayPay, making this a truly win-win situation.

Lastly, there is a high degree of compatibility between financial services and smartphone payments. In terms of payment services, in February 2022 we unveiled a deferred payment function. This function also offers users the option of switching to revolving payments after a purchase has been made and is designed to boost fee income for us whilst also accommodating the various payment needs of users. Small amount insurance is also a good fit for the ease of use of smartphones and is expected to grow in the future. For example, when you suddenly need to drive a friend's car, or when your business partner invites you to go golfing for the first time in a while, you can easily purchase car insurance or golf insurance for one day only on the “PayPay” app. We are confident that “PayPay” will establish its position as an accessible financial service because it is already used as a means of payment on a daily basis.

Profitability possible at any time if acquisition cost is scaled back

I have been asked by more people recently about when operating income at PayPay might swing to the black. In actual fact, PayPay could achieve operating profitability at any time now if we scale back the acquisition costs for new users and merchants. But as I mentioned before, we are looking at a ¥200 trillion market that is dominated by cash payments. In order to maximize the future corporate value of PayPay, I think it is still too early to ease up on efforts aimed at gaining customers. While we do give due consideration to economic efficiency, instead of targeting small-scale success in the near term, we want to achieve much greater success by turning “PayPay” into a national service much like the “LINE” app.

Standing at the forefront of the “Beyond Carrier” strategy and meeting the expectations of shareholders

Even though we are a member of the SoftBank Group, “PayPay” users are spread across all mobile phone carriers. This is because we intended “PayPay” to be a universal service used by all people since the service was launched. As SoftBank considers its group strategy, I believe that having a payment service within the group that is widely used by users of competing carriers will be a significant advantage. Going forward, we will continue to pursue our own growth, but at the same time, we will also push ahead with various synergy strategies as a member of the SoftBank Group and stand at the forefront of the “Beyond Carrier” strategy.

Four years have passed since PayPay was founded and during this time we have achieved considerable growth. Particularly large sums of capital were needed during the startup phase, but we were able to overcome that challenge thanks to the significant investments made by our shareholders, including SoftBank. I would like to extend my gratitude once again to all SoftBank shareholders for their considerable understanding and support thus far. Since they took a chance to invest in the future potential of “PayPay” from among the many other investment options available, we are determined to live up to their expectations and deliver results, so they know that their investments have paid off.

- Ichiro Nakayama

- Joined International Digital Communications Inc. (now IDC Frontier Inc.) in April 1994.

Appointed President & Representative Director in April 2013.

Appointed Director and Executive Vice President of Ikkyu Corporation in March 2016.

Assumed current position in June 2018.