On November 4, 2021, SoftBank Corp. (TOKYO: 9434) held its earnings results briefing for the second quarter (Q2) of the fiscal year ending March 31, 2021 (FY2021). President & CEO Junichi Miyakawa noted that consolidated revenue increased year-on-year (YoY) in Q2, and that SoftBank is on track to achieve its full-year operating income target, reaching 60% of the 975 billion yen full-year forecast. This full-year operating income target, if achieved, would represent a record high.

Making good progress toward record full-year revenue target

All of SoftBank's business segments saw increased revenues in Q2, and consolidated revenue came to 2,724.2 billion yen, a YoY increase of 12%, while operating income amounted to 570.8 billion yen. Steady profit increases in the Enterprise and Yahoo! JAPAN/LINE segments offset the impact on profits in the Consumer segment owing to intensified competition in mobile services.

Miyakawa explained that SoftBank is on track to meet all FY2021 full-year forecasts. In Q2, 50% was achieved for revenue and 59% for operating income. “Overall, we’re making steady progress” he said. If achieved, the full-year operating income target would be an all-time high.

Enterprise and Yahoo! JAPAN/LINE segments register strong performances

The Enterprise segment saw a 5% increase in revenue and a 15% increase in operating income, YoY. A 21% YoY increase in recurring revenue for Business Solution and Others revenue, which accounts for approximately 70%, helped offset the impact of the semiconductor shortage. Miyakawa said that he expects to see continued growth in this revenue base.

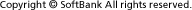

The Consumer segment saw a 6% YoY increase in smartphone cumulative subscribers despite the impact of intensified competition in mobile services. The number of 5G plan subscribers also surpassed 10 million in Q2.

The Yahoo! JAPAN/LINE segment saw a 35% YoY increase in revenue and an 18% increase in operating income owing to the business integration of Z Holdings Corporation and LINE Corporation in March 2021, as well as sound growth in the media business. Miyakawa also noted that e-commerce merchandise transaction value was up 10% YoY.

The smartphone payment service PayPay also continued grow, exceeding 43 million registered users and recording 1.66 billion payments in the first half of FY2021, an 81% increase YoY.

Gross Merchandise Value (GMV) also increased significantly to 2.4 trillion yen, an increase of 68% YoY. Starting October 2021, PayPay began charging small- and medium-sized merchants a system fee. Miyakawa explained that the financial impact of merchant cancellations was minimal, accounting for only 0.1% of GMV.

Enhancing corporate value by expanding into Asia-Pacific

Miyakawa rounded out his presentation with an update on Beyond Carrier and Beyond Japan growth strategy initiatives.

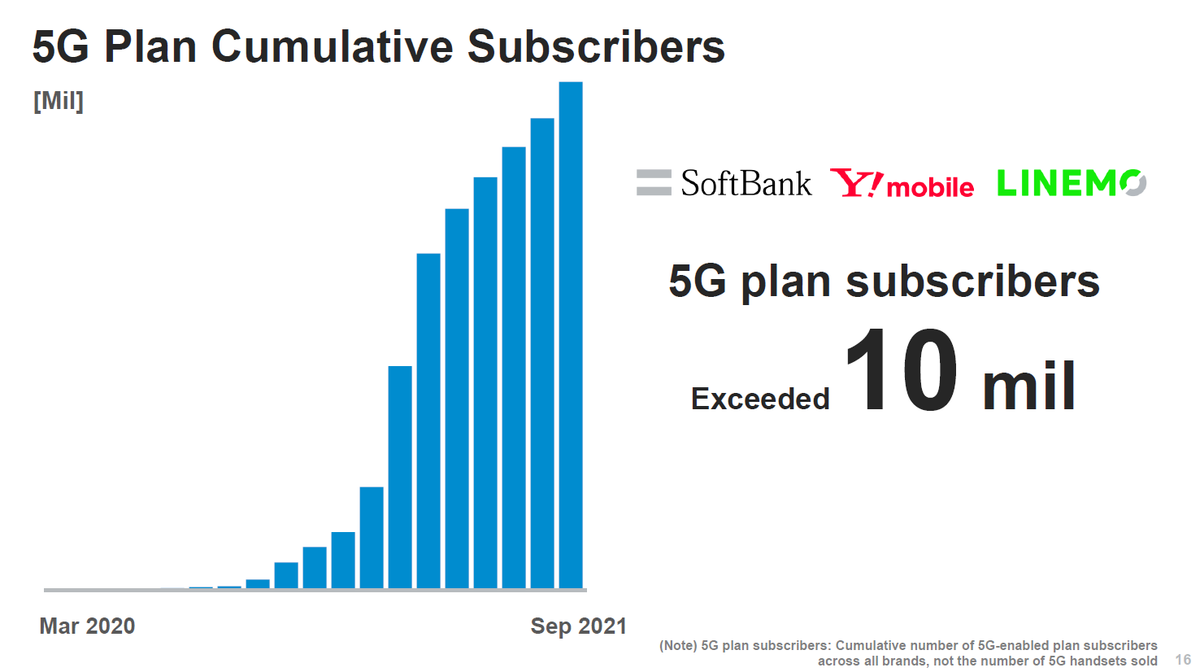

He announced an investment of US $222.5 million into Treasure Data, Inc., an enterprise customer data platform (CDP) provider that helps customers integrate and manage siloed customer data. Miyakawa noted the new investment in Treasure Data will have high synergies with group assets, which include Japan B2C leaders like Yahoo! JAPAN and LINE and SoftBank’s enterprise customer base. The investment will also help SoftBank develop DX businesses in Southeast Asia through its partnership with ADA.

Miyakawa also said that SoftBank signed a product partnership agreement with Axiata, a leading telecommunication group in Southeast Asia, to collaborate in digital marketing, payments, data and other fields.

Miyakawa noted that many Asia-based QR code payment providers are planning to participate in an international QR code payment network provided by TBCASoft Inc., a company that both SoftBank and Naver Financial Corporation have invested in. The participation of these QR code payment providers in Asia is expected to accelerate the expansion of an international QR code payment network.

Miyakawa closed his presentation by looking far out into the future. “We will take on the challenge of transforming all industries, promoting DX, and developing the technologies that will be needed by anticipating what could happen 30 or 50 years from now,” he said.

|

More info |

Presentation material (PDF: 6.65MB/50 pages) Supplementary materials: Overview of SoftBank (PDF: 1.80MB/20 pages) |

|---|

(First posted on November 2, 2021, updated on November 8, 2021)

by SoftBank News Editors