On February 7, 2024, SoftBank Corp. (TOKYO: 9434) President & CEO Junichi Miyakawa presented earnings results for the nine months ended December 31, 2023 (Q1-Q3) of the fiscal year ending March 31, 2024 (FY2023). At the press conference held in Tokyo, Miyakawa began by expressing his condolences to those affected by the Noto Peninsula Earthquake and explaining how SoftBank is restoring communications and providing support to people affected by the disaster.

Turning to SoftBank’s consolidated results, Miyakawa said that in FY2023 Q1-Q3, revenue (4,511.6 billion JPY), operating income (731.9 billion JPY), and net income (406.7 billion JPY) increased year-on-year (YoY) by 4%, 7% and 30%, respectively*.

- *

When including the PayPay remeasurement gain in FY2022 Q1-Q3, operating income and net income decreased by 25% and 20%, respectively

Full-year forecasts revised upward

Comparing SoftBank’s Q1-Q3 performance to the full-year forecasts for FY2023, Miyakawa noted that excellent progress has been made with 75% of revenue, 94% of operating income and 97% of net income already achieved. Accordingly, SoftBank’s FY2023 full-year forecasts have been revised upward, with new revenue, operating income and net income targets set at 6,060 billion JPY (up 60 billion JPY), 840 billion JPY (up 60 billion JPY) and 462 billion JPY (up 42 billion JPY), respectively. The net income upward revision notably represents a 10% increase over the initial forecast. Miyakawa attributed these increases to company-wide efforts at all businesses.

SoftBank’s FY2023 Q1-Q3 results also indicated that steady progress is being made toward achieving the Mid-term Management Plan targets that go to FY2025.

Consumer segment achieves mobile revenue growth turnaround ahead of plan

Miyakawa then reviewed each of SoftBank’s financial segments. For the Consumer segment, FY2023 Q1-Q3 revenue was down 0.3% YoY at 2,121.8 billion JPY, but a return to growth was achieved in mobile revenue when excluding customer acquisition measures and one-time factors. Miyakawa said he expects the increase in mobile revenue will continue in Q4, making it possible to achieve a return to growth for the FY2023 full year.

Miyakawa noted the turnaround in mobile revenue was achieved one year ahead of plan, and that he expects profit growth for the Consumer segment. Accordingly, the operating income forecast was revised upward to 490.0 billion JPY (a 20.0 billion increase over the initial forecast announced in May 2023).

Enterprise, Media & EC segments see increased revenue and operating income

In the Enterprise segment, FY2023 Q1-Q3 revenue (576.4 billion JPY) and operating income (124.8 billion JPY) increased by 5% and 15% YoY, respectively. The Media & EC segment, which incorporates the results of LY Corporation, posted revenue of 1,199.5 billion JPY, a 3% YoY increase, and operating income of 163.5 billion JPY, a 29% YoY increase.

In the FY2023 Q1-Q3 period, the Financial Business segment, which incorporates the results of PayPay Corporation, registered 170.9 billion JPY of revenue, a 95% YoY increase mainly due to the consolidation of PayPay in Q3 of FY2022, and an operating loss of 3.5 billion JPY. Assuming the PayPay consolidation took place in Q1 of FY2022, the Financial Business segment would have seen an actual improvement in performance. Miyakawa also noted that PayPay has been profitable in terms of consolidated EBITDA for three consecutive quarters.

Building foundations for future growth

After presenting financial results for FY2023 Q1-Q3, Miyakawa gave an update on SoftBank’s initiatives to build next-generation social infrastructure, which is key to its Long-term Vision.

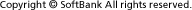

One pillar is building distributed computing infrastructure across Japan to counteract the heavy concentration of data processing and power consumption in urban areas. Miyakawa said significant progress is being made in building a network to connect the “Core Brain” and “Regional Brain” data centers and AI infrastructure, with an all optical nationwide network that enables energy-efficient and low-latency connections completed in October 2023, as announced with Fujitsu Limited. Compared to conventional backbone networks, the all optical network reduces power consumption by about 90% as it has no need for photoelectric conversion.

Stepping up generative AI initiatives

Miyakawa also updated attendees on SoftBank’s progress in developing homegrown large language models (LLMs), noting that SoftBank is now aiming to complete the development of multimodal LLMs with 390 billion parameters that incorporate graphs, tables, images, symbols and coding in addition to text before the end of FY2024. With these multimodal LLMs, SoftBank will aim to expand its computing platform to one with 1 trillion parameters. Miyakawa said these initiatives are being undertaken with the aim of providing energy-efficient generative AI services that are optimized for Japanese language and customs.

New opportunities for global growth

Miyakawa also touched upon the investment and partnership with Dublin-based Cubic Telecom, which was first announced in December 2023, as a key “Beyond Japan” initiative for future global growth. With the accelerating spread of software-defined connected vehicles (SDCVs), there will be an increased demand for IoT-based communication and connectivity, and Cubic Telecom will be an important partner, he said.

Highly evaluated for sustainability initiatives

In closing, Miyakawa said SoftBank’s ESG activities are being highly evaluated by third parties. Notably, it received the Grand Prize for the 5th Nikkei SDGs Management Award, first place for the GX500 Decarbonized Management Ranking, selection for DJSI World as the top scorer in Japan’s telecommunication industry for the second year in a row, and an AAA rating in the MSCI ESG Ratings.

|

More info |

Presentation material (PDF: 20.6MB/66 pages) Supplementary materials: Overview of SoftBank (PDF: 1.83MB/21 pages) |

|---|

(Posted on February 7, 2024)

by SoftBank News Editors