On May 11, 2021, SoftBank Corp. (TOKYO: 9434) held its earnings results briefing for the full year ended March 31, 2021 (FY2020). The earnings conference marked Junichi Miyakawa’s first as President & CEO. Opening the presentation, he said, “As a technology executive, I overcame a lot of challenges with founder Masayoshi Son. Now, as President, my aim is to build a resilient management structure. In this era of rapid digitalization, we need to to respond to unforseen challenges and turn headwinds into catalysts for rapid growth.”

Entering Phase 2 of the Beyond Carrier Growth Strategy

Outlining his Mid- to Long-term Vision, Miyakawa said that SoftBank is moving into the second phase of its Beyond Carrier growth strategy. He also stated his intention to be President & CEO for the next ten years, and pledged to focus on growing revenue and profits, as well as create value by developing new businesses.

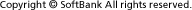

He also shared his thoughts on what he views as SoftBank’s winning formula: business timing, competitive strengths and a team that has high aspirations. Using this formula as a guide for allocating resources, SoftBank will be able to rapidly execute its management plans while building strong relationships with companies and partner companies, he said.

Showing the Value of New Businesses

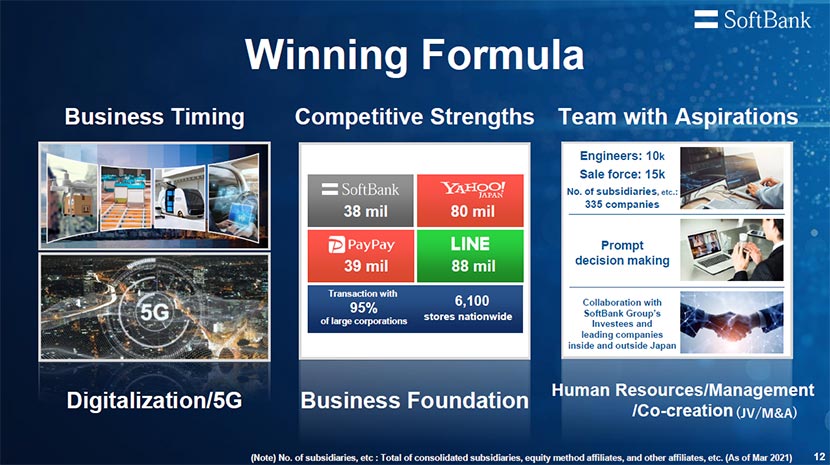

Turning to consolidated financial results for FY2020, Miyakawa noted that all business segments saw increased revenues and profits, and that the annual dividend per share is scheduled to be 86 yen per share, as originally forecast.

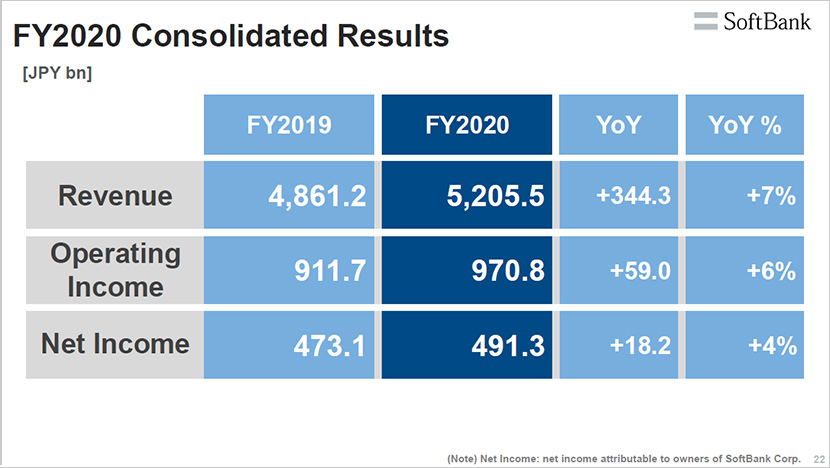

Looking to FY2021, Miyakawa affirmed his commitment to achieve targets for increased revenue and income. He also pledged to maintain high rates of shareholder return and to continue to pursue the FY2022 growth and shareholder return targets that were first announced in August 2020.

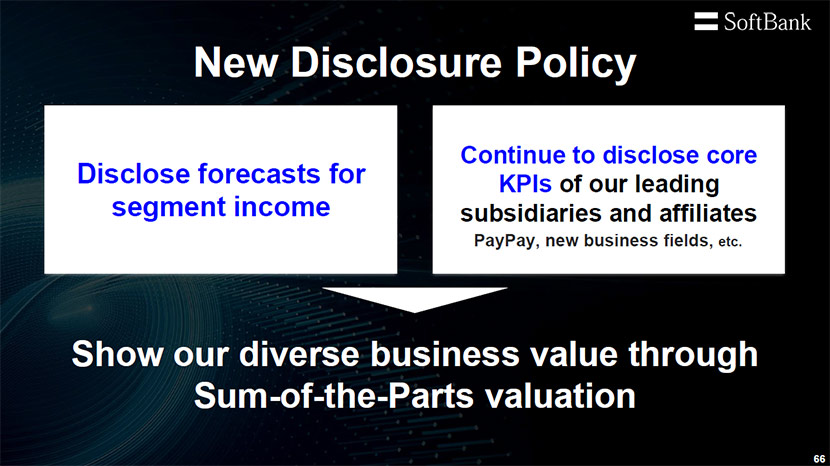

To better illustrate the diversified value of SoftBank’s businesses, Miyakawa unveiled a new disclosure policy that breaks out the forecasted income for each individual business segment and discloses the KPIs of promising group companies.

Focusing on generating synergies across group companies

Reviewing SoftBank’s business segments, Miyakawa highlighted the strong performance of the Enterprise segment. With its expansive enterprise customer base comprised of 95% of Japan’s listed companies, and by promoting a “B2B2C” business model that spans the SoftBank, Yahoo Japan, PayPay, and LINE user base, Miyakawa committed to an operating income target of 150 billion yen in FY2022.

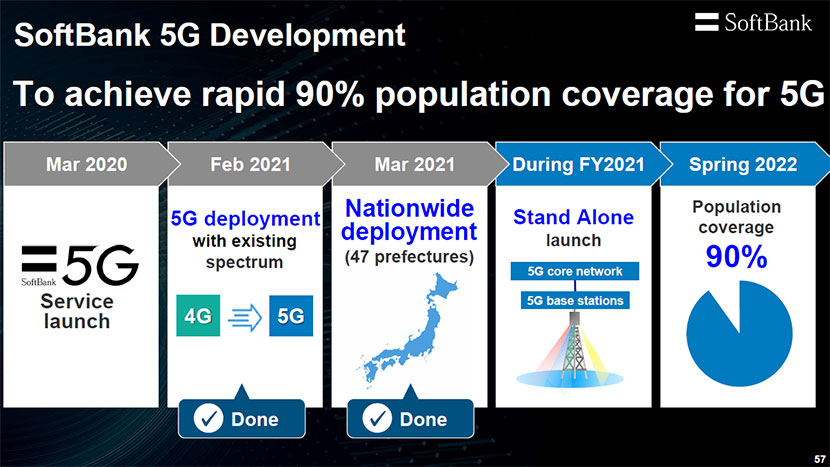

On the status of 5G deployment, Miyakawa said that SoftBank is on track to achieve 90% population coverage with its 5G network by the spring of 2022.

For the Consumer segment, Miyakawa stated his goal to make SoftBank No. 1 in smartphone subscriptions with the multi-brand strategy. The brands consist of the large capacity ‘SoftBank’ brand, the mid/low capacity ‘Y!mobile brand,’ and the newly added medium capacity and online exclusive ‘LINEMO’ brand. He added that SoftBank will continue to pursue differentiation and provide customer benefits under this strategy.

Turning to the E-Commerce business, Miyakawa acknowledged there is room for improvement in the distribution network in Japan. He said that by increasing collaboration with LINE and other group companies, SoftBank will strive for the No. 1 E-Commerce position in Japan.

PayPay registers 3.2 trillion yen in GMV

Miyakawa also highlighted the remarkable growth of mobile payment provider PayPay in his presentation. For the first time, PayPay’s gross merchandise volume (GMV) was disclosed to better illustrate the value of SoftBank’s businesses. In FY2020, PayPay registered a remarkable 3.2 trillion yen in annual GMV, a 2.6-fold increase over the previous fiscal year.

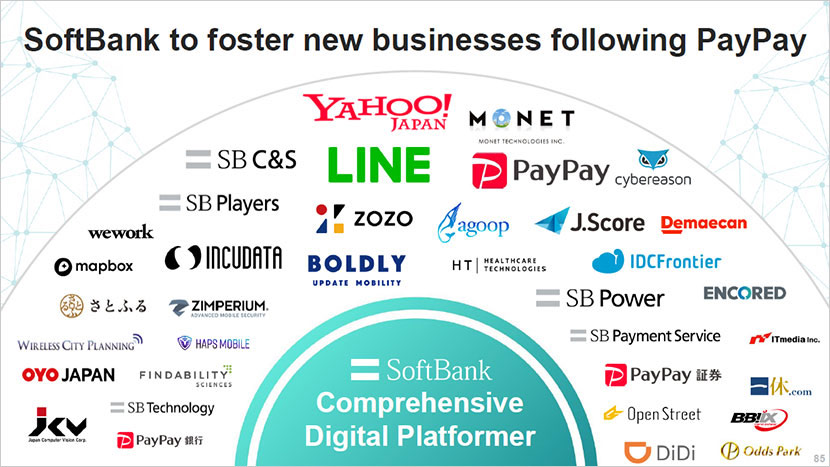

With its ties to various SoftBank-related services, Miyakawa stated that PayPay is helping to build a FinTech ecosystem and is rapidly evolving into a super app that will further drive synergies across group companies. He stressed that PayPay is playing a key role in enabling SoftBank to be a “Comprehensive Digital Platformer.” Miyakawa also mentioned that many other new businesses have similar potential for growth.

Going global through tie-ups with major Asian technology giants

Miyakawa also spoke about SoftBank’s developing global business, first by detailing a capital and business alliance with ADA, a subsidiary of the Malaysia-based Axiata Group, a major telecommunication group in Southeast Asia. In the tie-up, SoftBank will combine its digital market solutions with ADA’s AI and data know-how and its extensive network in nine Asian countries.

Miyakawa also told the audience that SoftBank is collaborating with Korea-based technology giant NAVER now that LINE has joined the group. With a newly strengthened relationship, SoftBank and NAVER are actively studying opportunities at steering committees to jointly deploy businesses in Southeast Asia.

Pledging to help realize a decarbonized society

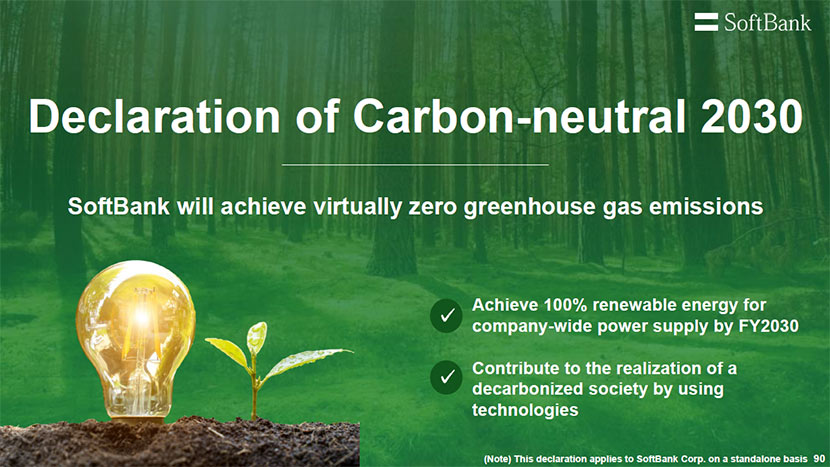

Closing his presentation, Miyakawa unveiled SoftBank’s Carbon-neutral 2030 Declaration to contribute to the achievement of SDGs and solve social issues through business growth. In addition to the goal of bringing greenhouse gas emissions down to virtually zero by FY2030 by making a complete switch to renewable energy power sources*, Miyakawa restated his goal of developing a resilient management foundation, one of SoftBank’s priority issues to achieve the SDGs.

|

More info |

|---|

- *

More than half of SoftBank’s power consumption comes from operating its approximate 230,000 base stations across Japan. Since FY2020, SoftBank has been purchasing electricity from renewable sources for its base stations from its subsidiary SB Power Corp. At the end of FY2020, approximately 30% of the electricity used at base stations came from renewable sources. In FY 2021, SoftBank plans to increase the ratio to more than 50% in FY2021 and to more than 70% in FY2022 to reduce greenhouse gas emissions.

(First posted on May 11, 2021, updated on May 19, 2021)

by SoftBank News Editors