The English edition of SoftBank Corp.’s (TOKYO: 9434) Integrated Report for 2025, published on October 31, 2025, provides a comprehensive overview that includes a look back at the fiscal year ended March 31, 2025 (FY2024), management’s perspectives on medium- to long-term growth strategies centered on AI, financial strategies, and shareholder returns. It also introduces SoftBank’s strategies aimed at realizing “Next-generation Social Infrastructure,” as well as its initiatives related to ESG and risk management.

A message from Board Director, Executive Vice President & CFO Kazuhiko Fujihara, is featured in the report. Below is an excerpt.

SoftBank Integrated Report 2025

Every year, SoftBank publishes an Integrated Report, a comprehensive document that includes information on its vision, medium- to long-term growth strategies, value creation processes, materiality, and financial and non-financial information.

CFO’s FY2024 Review: Revenue and profit increased in all segments and Mid-term Plan targets achieved ahead of schedule

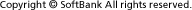

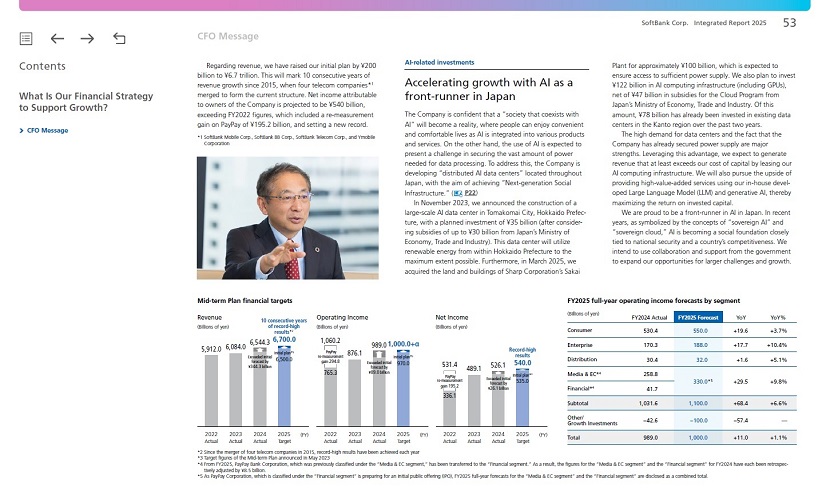

FY2024, the second year of our Medium-term Management Plan (“Mid-term Plan”), was a highly successful year with all segments achieving increases in revenue and profit. All segments even exceeded their upwardly revised plans, allowing us to achieve our Mid-term Plan targets (revenue of ¥6.5 trillion, operating income of ¥970 billion) announced in May 2023, one year ahead of schedule. In the Consumer segment, profitability improved significantly due to an increase in smartphone subscribers and a stabilization in ARPU, along with thorough cost control, leading to an increase in segment income of more than ¥30 billion from the previous year. In the Enterprise segment, excluding one-time factors recorded in the previous year, we achieved an underlying increase of approximately 8% in segment income.

Over the two-year period since the Mid-term Plan was launched in FY2023, we have achieved double-digit growth, progressing smoothly in line with the initially targeted growth pace. In the Media & EC segment, there was a one-time uplift in segment income from a gain on loss of control over subsidiaries, but even excluding this, the business achieved a 20% increase in profit. In the Financial segment, PayPay maintained GMV growth of over 20% year on year while implementing effective cost control, thus becoming profitable at the segment level.

Over the course of his message, Fujihara discusses SoftBank’s policies from a CFO perspective, including a review of FY2024 results and the outlook for FY2025, financial strategies, and the Company’s approach to achieving both further growth in the AI field and a high level of shareholder returns.

His entire message can be found here.

(Posted on November 4, 2025)

by SoftBank News Editors