On February 10, 2025, SoftBank Corp. (TOKYO: 9434) President & CEO Junichi Miyakawa presented earnings results for the first nine months (April - December, 2024) of the fiscal year ending March 31, 2025 (FY2024 Q1-Q3). At the press conference held in Tokyo, Miyakawa started with a review of SoftBank’s consolidated results.

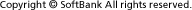

For FY2024 Q1-Q3, revenue (4,811.5 billion JPY), operating income (821.9 billion JPY), and net income (436.6 billion JPY) increased year-on-year (YoY) by 7%, 12% and 7%, respectively. Revenues and profits increased across all of SoftBank’s business segments (Consumer, Enterprise, Distribution, Media & EC and Financial Business).

Among the FY2024 Q1-Q3 financial results reported by the three major telecommunications carriers, SoftBank was the only company to achieve a double-digit increase in operating income and an increase in net income.

The results were mainly attributable to a continued increase in mobile revenues in the Consumer segment, higher profits in the Financial Business segment driven by PayPay, and a major increase in profit at the Media & EC segment.

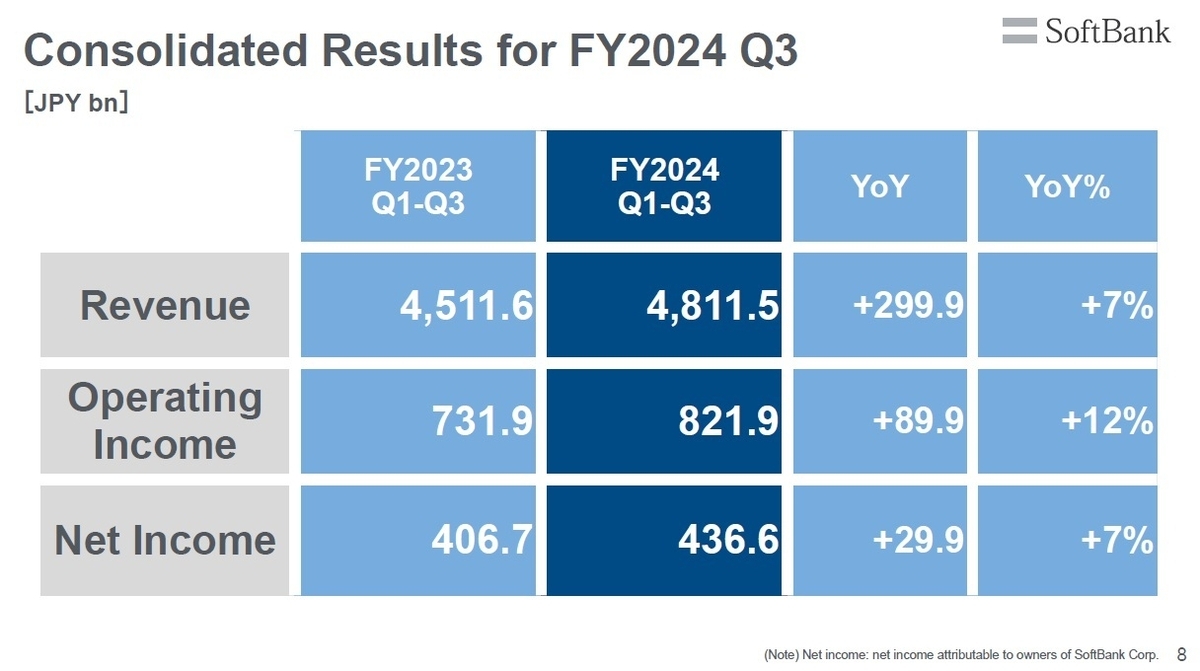

Forecasts for revenue, operating income and net income revised upward

Comparing SoftBank’s FY2024 Q1-Q3 performance against the full-year forecasts for FY2024, which were upwardly revised in November 2024, Miyakawa noted that steady progress is being made, with 76% of revenue, 87% of operating income and 86% of net income already achieved.

With regard to the Medium-term Management Plan, which is now in its second phase and runs from FY2023 to FY2026, SoftBank’s progress is ahead of schedule.

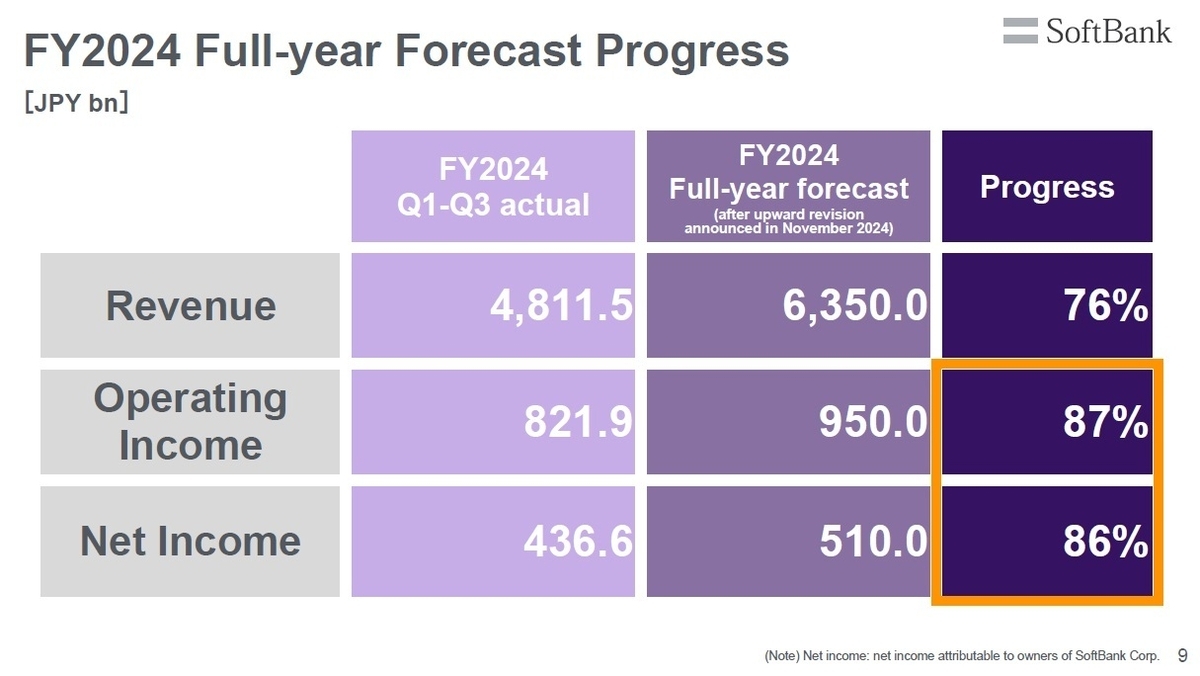

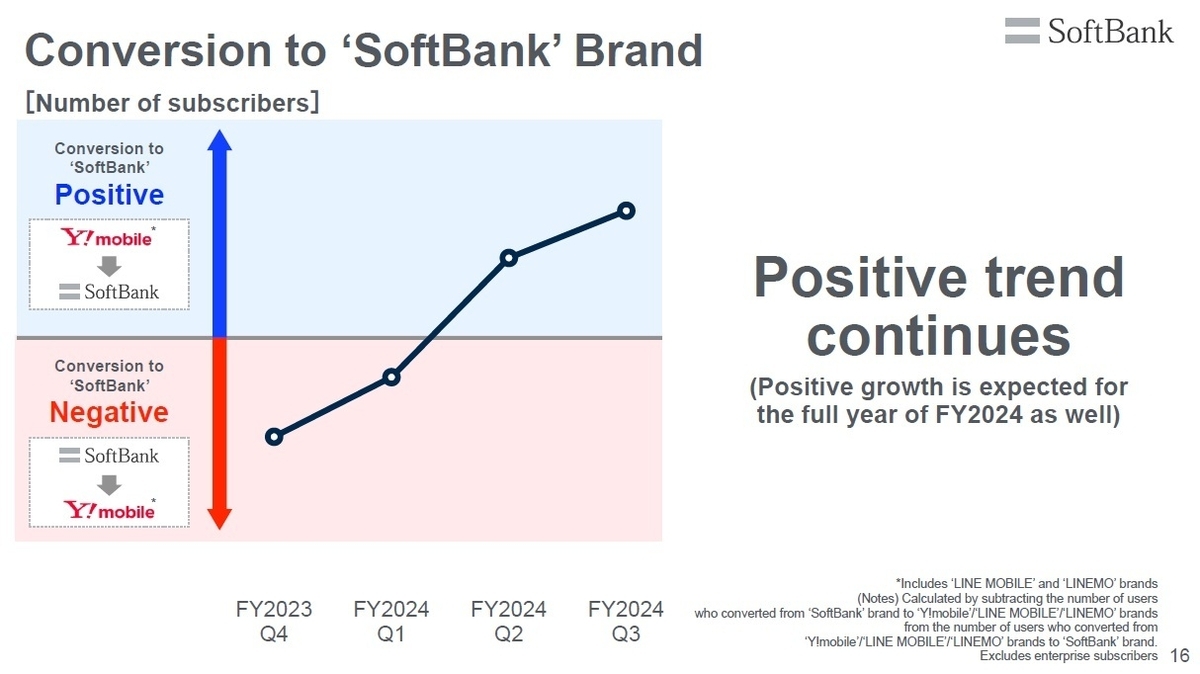

Positive trend of migration to ‘SoftBank’ mobile service brand continues

Reviewing the highlights of SoftBank’s business segments in detail, Miyakawa noted that in the Consumer segment, an increase in smartphone subscribers and customer spending contributed to a continued increase in mobile revenue in FY2024 Q1-Q3, which was up 25.6 billion JPY (+2%) YoY at 1,177.0 billion JPY. Miyakawa added that mobile revenues, which were impacted by service price reductions four years ago, are now back on a growth trajectory.

The trend of more conversions from SoftBank’s ‘Y!mobile’ brand to its ‘SoftBank’ brand also continued, resulting in higher customer revenues. Miyakawa said he expects the positive growth trend to continue to the end of FY2024.

The Enterprise segment registered 673.6 billion JPY of revenue in FY2024 Q1-Q3, a 10% increase YoY, driven by steady growth in business solutions and others, which saw a 27% YoY increase in revenue. FY2024 Q1-Q3 operating income for the Enterprise segment was 140.4 billion JPY, a 9% YoY increase.

The Media & EC segment, which incorporates LY Corporation (the operator of LINE and Yahoo! JAPAN services), also saw growth in revenue and operating income, with YoY increases of 4% and 33%, respectively. When excluding one-time factors, Media & EC operating income was up 17% YoY.

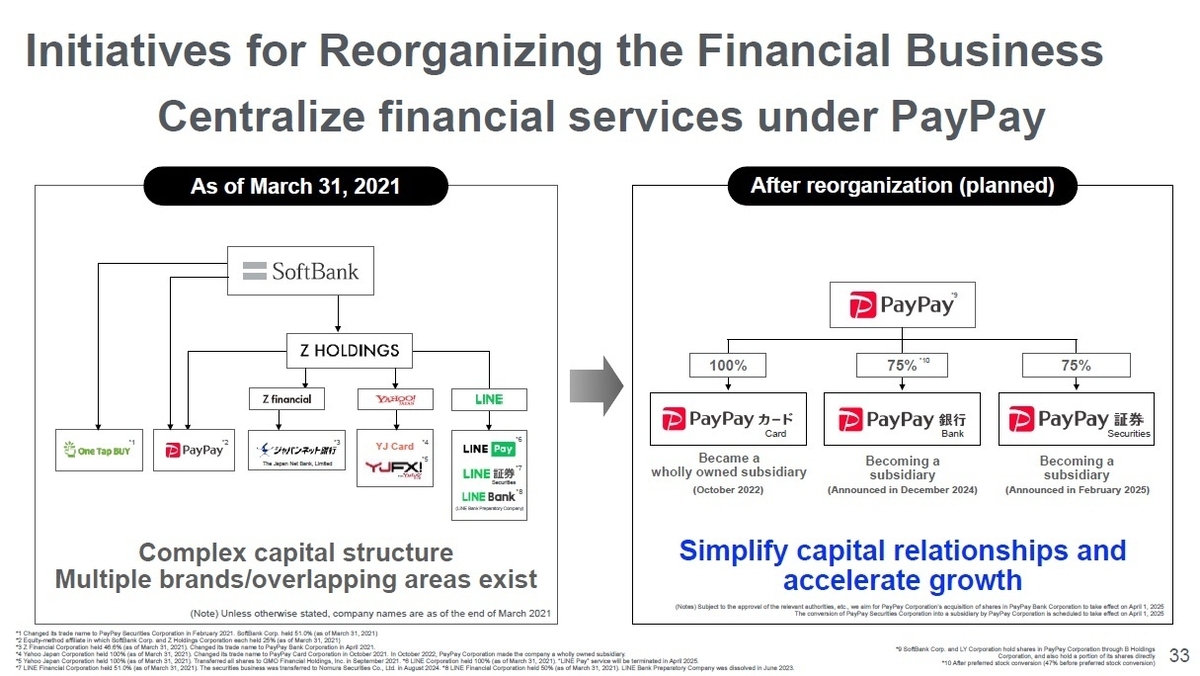

Concentrating financial services under PayPay to accelerate financial business growth

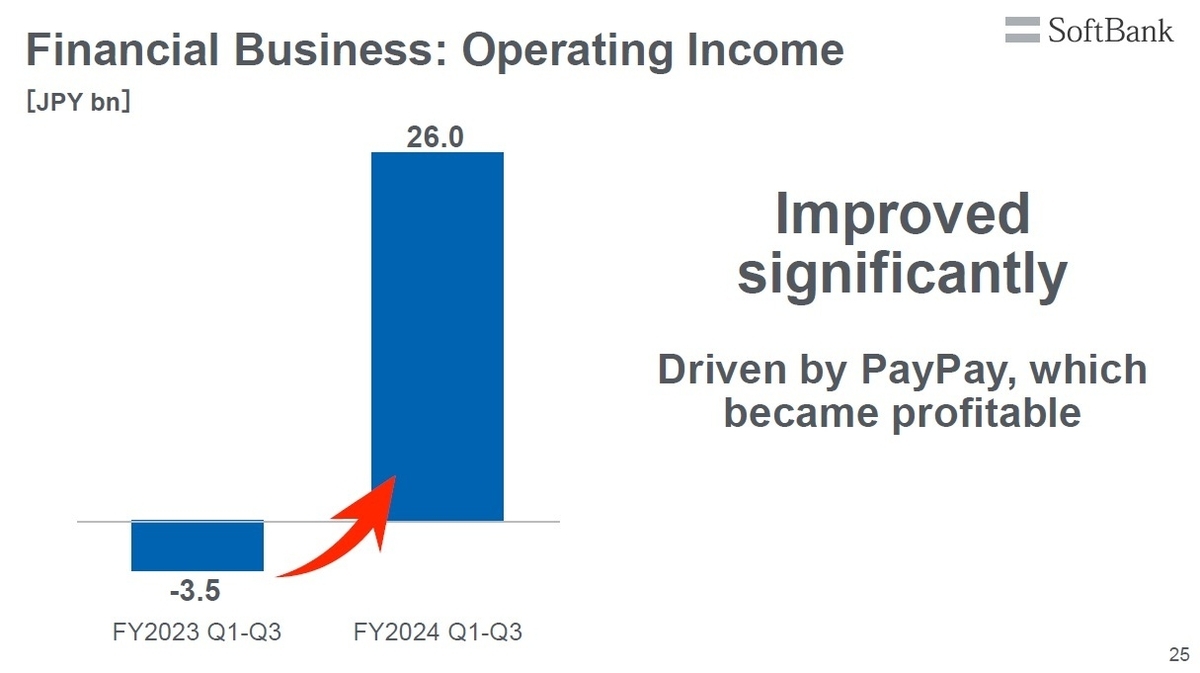

In the Financial Business segment, FY2024 Q1-Q3 revenue was up 19% YoY at 203.6 billion JPY and operating income reached 26.0 billion JPY, a major improvement compared to the operating loss of 3.5 billion JPY registered in the previous fiscal year. The increase was driven by improved performance at PayPay, which became profitable.

To further strengthen and accelerate the growth of the financial business, Miyakawa explained that PayPay will be acquiring shares in both PayPay Securities and PayPay Bank, giving it a 75% stake in both companies and making them both subsidiaries. This planned reorganization, which is scheduled to take effect on April 1, 2025, will enable PayPay to accelerate the integration of financial services across the PayPay group, enhance products and services, and promote new financial experiences for customers through the PayPay app.

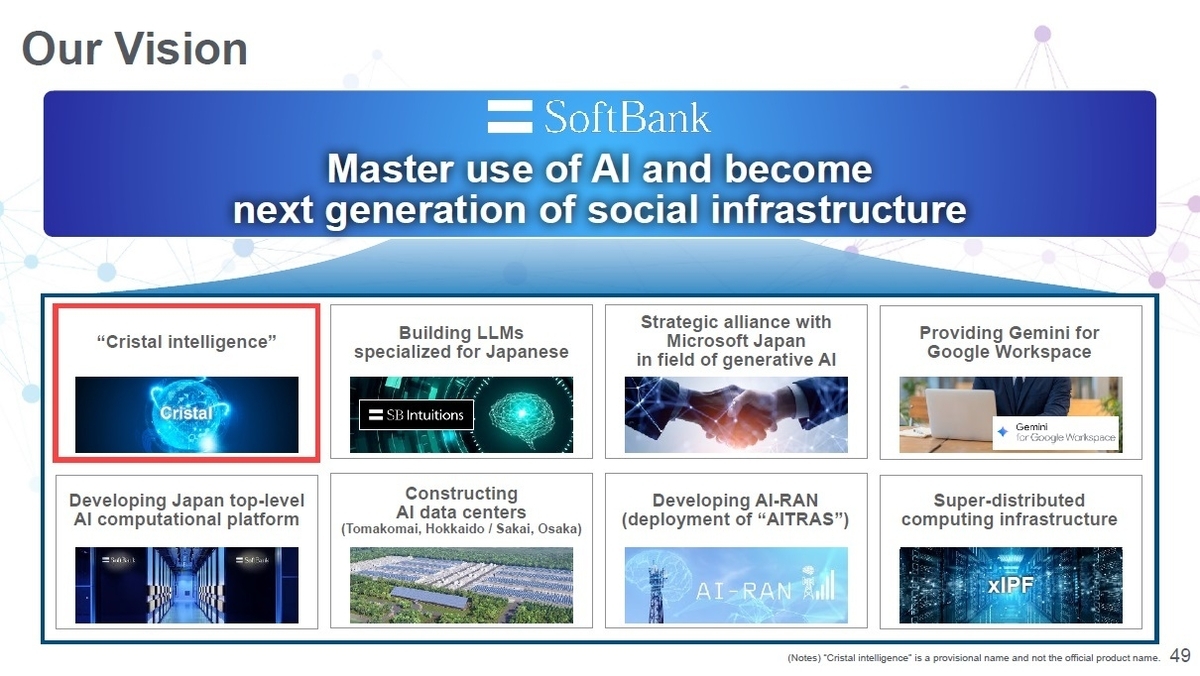

Making progress on next-generation social infrastructure initiatives

Miyakawa provided an update on SoftBank’s next-generation social infrastructure initiatives, highlighting that AI-RAN, a technology that integrates AI into radio access networks (RAN) for wireless communications, is helping SoftBank realize distributed AI centers and making it possible to develop new revenue streams through the utilization of idle computing resources. Noting that SoftBank decided to acquire the land and buildings of the Sharp Sakai Plant to construct a new AI data center, Miyakawa outlined a concept to utilize AI data centers as industrial hubs that can promote regional growth by revitalizing industries with AI.

Miyakawa also highlighted that SoftBank will play a key role in the rollout of “Cristal intelligence,” and advanced enterprise AI service, through a joint venture between OpenAI, SoftBank Group Corp. and SoftBank Corp. called “SB OpenAI Japan.” Miyakawa noted that SoftBank plans to second its engineers and sales staff to the joint venture to assist clients with implementation.

Miyakawa also stressed that SoftBank will continue to develop homegrown LLMs specialized for the Japanese language and provide other third-party AI services.

|

More info |

Presentation material (PDF: 17.7MB/57 pages) Supplementary materials: Overview of SoftBank (PDF: 1.63MB/22 pages) |

|---|

(Posted February 10, 2025)

by SoftBank News Editors