Earlier this year, the editors of PayPay Inside-Out and SoftBank News teamed up to learn more about the state of cashless payments around the world by checking with PayPay employees, who hail from more than 40 countries and regions. As the results showed, we received a lot of interesting data and responses, which in turn raised more questions.

In our second collaboration, we decided to take a deep dive to learn more from PayPay employees about state of cashless around the world, and to see how Japan compares.

This Month’s Theme: a Comparison of Cashless Overseas and in Japan

The Editors

Barriers to cashless adoption in Japan

From a global perspective, Japan is still behind the general trend toward a greater the adoption of cashless payments. Why is this the case?

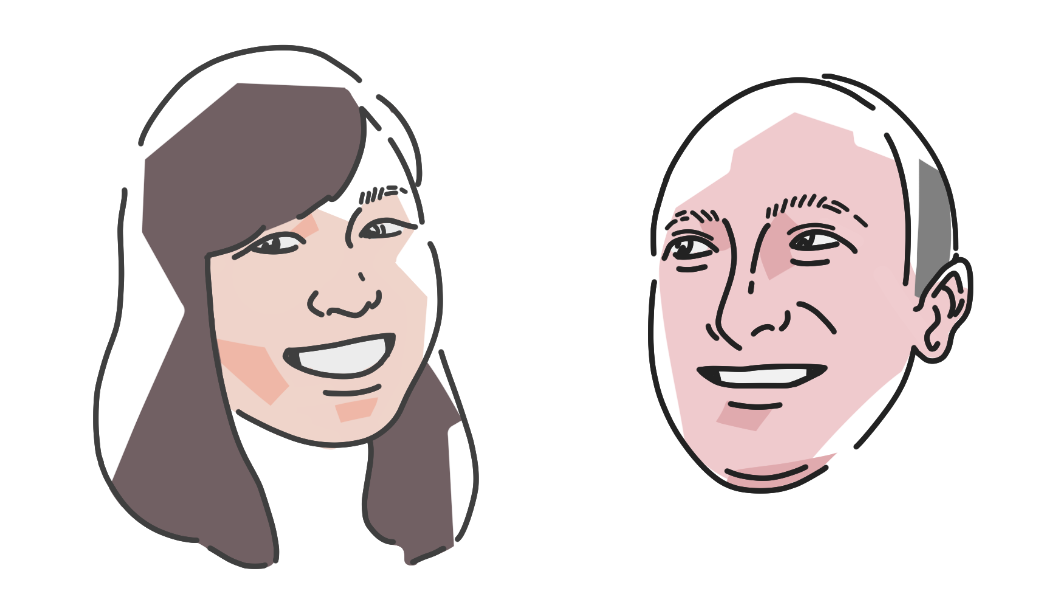

People who think cashless is widespread in their home country

“Of the 17 countries and regions surveyed, only Vietnam was considered to be behind the cashless curve.”

Some PayPay employees said demographics is part of the reason. Japan has an aging population, and for many in the older age bracket, understanding how to use apps and mobile payments is difficult, explained an employee from India. An employee from Malaysia noted that trust in technology among the elderly of Japan tends to be low, and, by way of example, said his/her Japanese in-laws prefer to use cash. An employee from the US added, “Older people aren't comfortable with technology, and technology here is still difficult to use.”

Cultural attitudes and Japan’s relative safety may have also slowed cashless adoption. A PayPay employee from Russia explained that the majority of Japan’s population, especially business and political influencers, are people who spent most of their lifetime in the 20th century, where cash was the main payment method, and for them, cash is more reliable and comfortable. PayPay employees who lived in the Netherlands and the US also noted that, due to Japan’s low crime rate, many do not seem to mind carrying around large amounts of cash.

Not everyone agreed that Japan is behind the cashless curve, however. A PayPay employee from Taiwan countered by saying, “Actually, I don't think Japan is slow [to adopt cashless payments]. In Japan, credit cards, Suica [chargeable IC cards] and QR payments are more useful than where I come from.”

Contactless credit card payments widely used in some parts of the world, but not in Japan

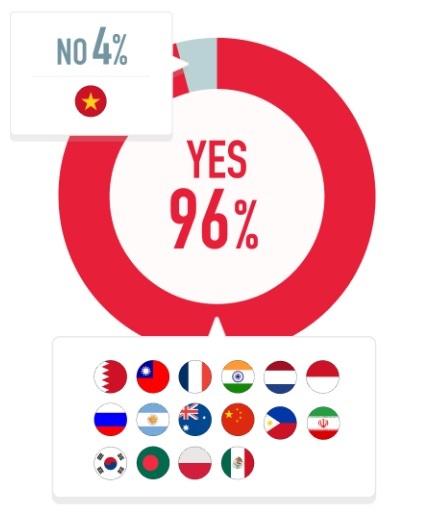

In the survey results from the previous article, employees from France, Iran, the Republic of Korea, Bangladesh and Poland said that credit cards were a highly preferred method of cashless payments. This is partly due to the wide usage of contactless credit card payments, a feature not yet widely used in Japan.

Daily Payment Situations Overseas

“For countries like France, the Republic of Korea, Iran and Poland that have a well-established base of credit card users, barcode-based payment services are virtually nonexistent.”

A PayPay employee from France elaborated, “In France, the QR code payment would not work, simply because near field communication (NFC) payments are much easier. You can link a credit card into Apple Pay or Google Pay, then directly pay with the phone with a single contactless tap.”

Furthermore, an employee from the Republic of Korea noted that credit cards have been firmly entrenched in the country for some time now, and that this is making it difficult for new payment technologies to gain a foothold.

By contrast, an employee from Argentina noted that while contactless payments are widely used there, most people use NFC with debit cards, not credit cards.

In closing

In light of the fact that barcode-based payment services are not as widely used in Europe and the Americas as they are in Asia, some PayPay employees from Europe noted that PayPay’s service, which now has over 50 million registered users at this time of writing, could improve in some ways.

A PayPay employee who spent time in the Netherlands noted that, compared to NFC payments, barcode-based payments take longer to process since scanning is involved, and employee from France suggested that PayPay should urgently consider introducing NFC payments. An employee from Russia added that barcode-based payments are also reliant on mobile network connections and smartphone battery power (a topic SoftBank News recently covered).

“The speed of cashless transactions was a key consideration for the PayPay employees surveyed, especially in places like supermarkets where there can be long lines.”

In contrast, many PayPay employees praised the merits of using PayPay’s barcode-based payment services since they came to Japan. An employee from Mainland China said that with PayPay there’s no need to carry a wallet around anymore. And an employee from Taiwan noted that the cashback campaigns are another key advantage over other methods of payment.

A PayPay employee from Malaysia explained that his/her barcode payment journey began before coming to Japan when using the cab booking app ‘Grab,’ which requires a wallet pre-load to book a ride. “Later they introduced their payment service. As I was already using their cab booking app, it was convenient for me to pay for different services using the same app.”

Like Grab, the PayPay app has functions that provide access a wide range of convenient services that make it easy to order food, make movie ticket reservations, use HELLO CYCLING’s bike-sharing services and more.

“What did you think of this article? Share it on social media if you'd like!”

(Posted on August 31, 2022)

by PayPay Inside-Out and SoftBank News Editors

Collaborator

PayPay Inside-Out offers the latest news of PayPay, focusing on the people and the culture that makes PayPay unique.