Press Releases 2019

- Previous Page

- Next Page

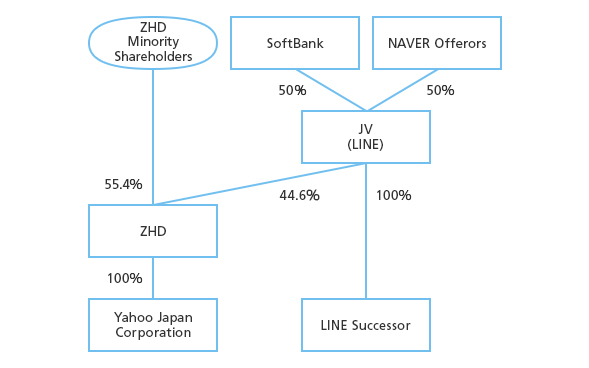

Attachment 1 Schematic Diagram of the Business Integration

| Current status (As of today) |

|

|---|---|

| ① The Joint Tender Offer (Joint tender offer for LINE shares, etc.) And ② The Squeeze-out |

|

|

|

| ③ The Tender Offer for ZHD Shares And ④ The Bond Issuance (Issuance of corporate bond by LINE) |

|

|

|

| ⑤ The Merger (Merger of Shiodome Z Holdings and LINE) And ⑥ The JV Conversion Transaction (Transaction to adjust the voting rights ratio in LINE held by SoftBank and the NAVER Offerors to 50:50) |

|

|

|

| ⑦ The Corporate Demerger (Demerger by LINE of all of its business to the LINE Successor) |  |

|

|

| ⑧ The Share Exchange (Share exchange between ZHD and LINE) |  |

|

|

| After the Business Integration |  |

- Previous Page

- Next Page