Segment composition ratio

- [Notes]

-

- *1The components of revenue represent sales to external customers.

- *2Operating income of the Distribution segment for FY2023 is ¥26.2 billion.

- *3Operating loss of the Financial segment for FY2023 is ¥5.0 billion.

- *1

Business strategy

Our mobile communications service provides services and price plans suited to user needs to increase the total number of smartphone subscribers.

Three competitive advantages

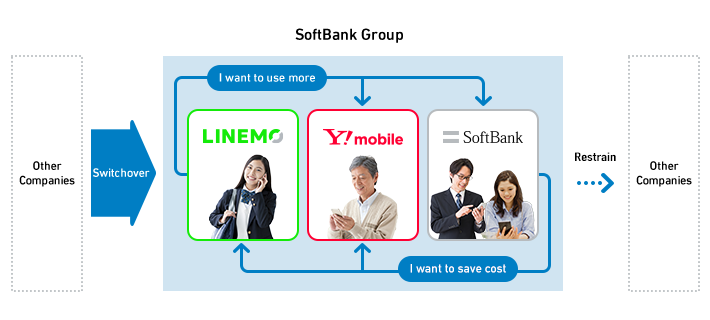

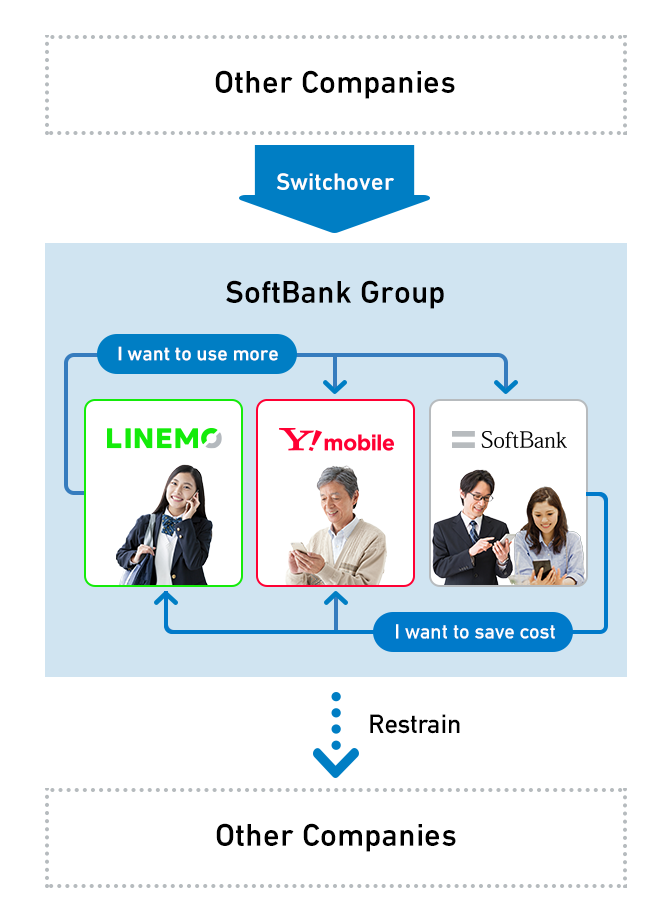

1. Multi-brand strategy

The Company provides three brands with differentiated characteristics: SoftBank, where users can use the smartphones with unlimited data plans, Y!mobile, which has lower monthly charges for medium to low data usage, and LINEMO, the online exclusive brand with functions that users can carry out all types of procedures and receive support online. By responding to changing user needs, the Company aims to drive user transition among brands within the Group, expand acquisition of new subscriptions, and prevent users from moving outside the Group.

2. Synergy with leading services offered by group companies

Our group holds a number of leading services, such as Yahoo! Japan, one of Japan's largest comprehensive Internet service, LINE, a national communication app, and PayPay, a QR and barcode payment service with the largest share in Japan. We provide advantages to our mobile users through the synergy of these group services with powerful support in the entertainment, online shopping, social media, and payment/finance fields. By ensuring differentiation from our competitors, we are able to acquire new subscribers and promote continued usage.

3. High-quality communications networks

The Company provides wonderful user experience through our high communications quality. Our 4G LTE network has gained the best quality ranking from a global research organization. We are also developing 5G network to rapidly achieve a high level of quality nationwide.

Business target

| Mobile service revenue |

To hit bottom in FY2023 and return to growth (Progress in FY2023) |

|---|---|

| Segment income |

To hit bottom in FY2022 and return to growth (Progress in FY2023) |