IR Activities

As part of the strengthening of corporate governance system, SoftBank Corp. is working to promote active information disclosure and enhance communication in its IR activities.

Basic policy on disclosure

The Company appropriately discloses both financial and non-financial information in compliance with relevant laws and regulations and the rules of the Tokyo Stock Exchange. Furthermore, the Company also strives to actively provide more information than required by laws and regulations and the Tokyo Stock Exchange when necessary by carefully considering the impact on investors and other stakeholders. In either case, the Board of Directors strives to ensure that the Company's information disclosure is always fair, clear, and useful.

Disclosure standards

and methods

We believe that the timely and appropriate disclosure of financial and non-financial information is important in order to engage in constructive dialogue with shareholders and investors with the aim of enhancing corporate value over the medium to long term. Therefore the Company discloses information according to the statutory disclosure requirements based on the Financial Instruments and Exchange Act and other relevant acts and ordinances, and as required by the Rules on Timely Disclosure set by the Tokyo Stock Exchange. The Company also discloses critical information that is not subject to either statutory disclosure or timely disclosure requirements but could potentially affect investment decisions. This information is disclosed in a fair and prompt manner so as to give all the stakeholders equal access to it.

The Company discloses information required by the timely disclosure regulations through TDnet (Timely Disclosure network) provided by the Tokyo Stock Exchange and also releases information to the press immediately. Information that is disclosed on TDnet or by other means is also promptly posted on its website.

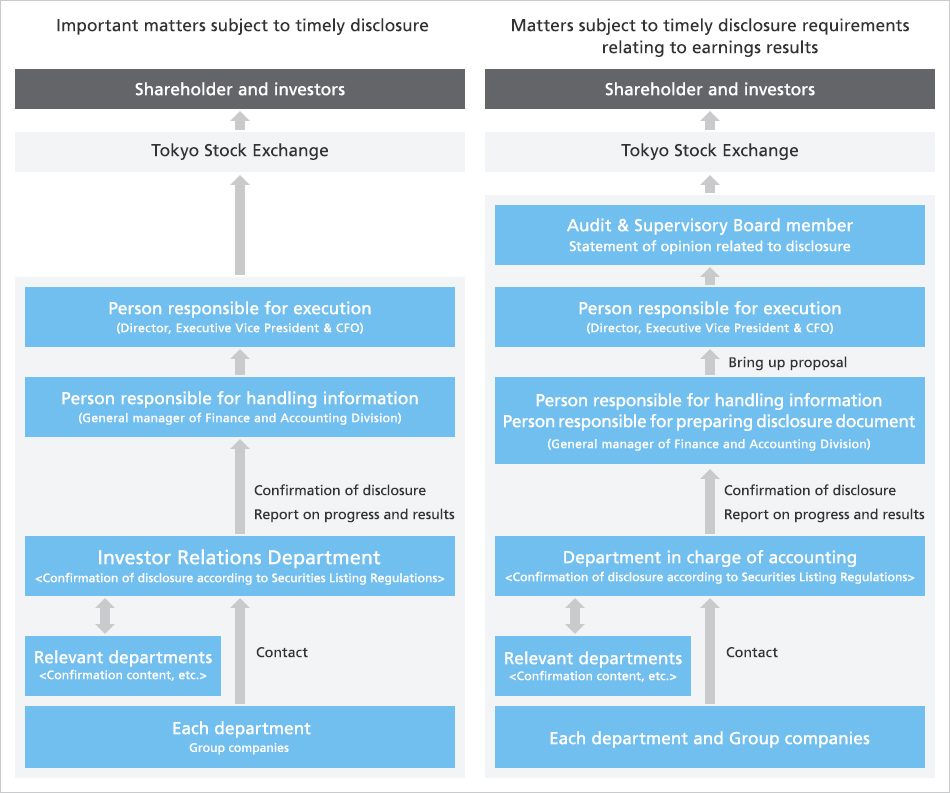

Information disclosure system

The Company conducts timely disclosure with the Investor Relations Department as the responsible department. The IR Rules set out matters to be reported to the Investor Relations Department related to timely disclosure, including required reporting times and procedures. When timely disclosure is necessary, the Investor Relations Department prepares timely disclosure materials in close coordination with related departments such as business units, Accounting, Finance, Legal, and General Administration and swiftly conducts timely disclosure under the supervision of the Director, Executive Vice President & CFO in charge.

Matters subject to timely disclosure requirements related to earnings results are compiled into a disclosure document by the department in charge of accounting and relevant departments based on information collected from group companies. The general manager of the Finance and Accounting Division is responsible for preparation of the disclosure document related to earnings results. The document is swiftly disclosed under the approval of the Director, Executive Vice President & CFO in charge.

Basic policy on dialogue

with shareholders

We believe that constructive dialogue with our shareholders is crucial to achieving sustainable growth. The senior management including board directors, and IR Office are engaged in dialogue with shareholders and investors, as long as it is reasonably possible. Meetings are organized between shareholders and the President & CEO, and between institutional investors and the executive officers in charge of investor relations from time to time. During the dialogue, we respect the fair disclosure rules and take great care to handle material information under insider trading regulations.

IR Office not only regularly compile and report to management the views and concerns of shareholders and investors obtained through the dialogue, but also share the information with the related departments within the Company and use the feedback in our business activities to enhance corporate value.

IR activities

The Company engages in the following activities regarding the dialogue with its shareholders. At earnings results briefings and other events, senior management themselves explain the earnings results and business strategy as speakers. Live streaming and video on-demand of the earnings briefings are available on our website. The Company makes continuous effort to enhance dialogue with shareholders and investors, by participating in roadshows and conferences in Japan and abroad, 1-on-1 and various small meetings with investors, organizing briefings for individual investors and responding to inquiries daily.

| Activities | Contents |

|---|---|

| Regular briefings for individual investors (in Japanese) | The Company provides clear and highly useful information to individual shareholders and investors. Since information is disclosed to a large number of shareholders and investors, the primary means of disclosure is on the website. At the same time, the Company focuses on dialogue also by holding online accompanied with real-time Q&A sessions online and at head offices of securities companies throughout Japan. |

| Regular briefings for analysts and institutional investors | When earnings results are announced, the Company holds earnings results briefings for analysts, institutional investors, and the media. The President & CEO and CFO explain the business status, strategy, measures and outlook regularly. The Company livestreams earnings results briefings for analysts and institutional investors on its website. The footage is posted on the website soon after the briefings. |

| Active information disclosure to overseas investors | The Company's delegates visit institutional investors outside Japan to explain the business status, strategy, measures and outlook. With regard to the disclosure of materials in English, we make every effort to ensure that the gap between English and Japanese is kept to a reasonable level in terms of timeliness and volume of information. The Company provides livestreaming of earnings results briefings in English on its website. The footage becomes available on the website after the briefings. |

| 1-on-1 meetings with domestic and overseas institutional investors | We conduct 1-on-1 meetings with domestic and overseas institutional investors. We accommodate various meeting formats as per the preference of institutional investors, which range from face-to-face meetings at the investor's or our offices to non-face-to-face meetings such as online or phone conferences. Furthermore, we actively participate in investment bank conferences held both domestically and internationally to maximize our dialogues with institutional investors. |

| IR documents on our website | Various IR documents are available on our website.

|

Feedback to Management

| Items | Frequency | Details |

|---|---|---|

| Summary of analyst reports | On the day of earnings announcement and when necessary | A summary of sell-side analyst reports is reported to the management |

| Feedback from investors and sell-side analysts | Several weeks after earnings announcement | Feedback received through investor and analyst meetings conducted after earnings announcement is reported to the management and external directors |

| IR-related reports | Monthly | Analyst's target stock prices, other stock-related indicators, and key IR activities are reported to the management |

| Stock-related indicators and shareholder information | Anytime | Analyst's target stock prices, other stock-related indicators, and shareholder information are consolidated into a dashboard available anytime for viewing. |

| Others | Timely | Provide timely reports on feedback, evaluations, and relevant indicators received through dialogue, as necessary. |

Achievements from the dialogues with shareholders and investors

| Requests | Achievements |

|---|---|

| Provide opportunities for dialogue with external directors | In April 2022, we held a small meeting between external directors and institutional investors. The meeting focused on the effectiveness of the board of directors and the group governance. |

| Expand information disclosure for better corporate analyses | Since the fiscal year ended in March 2022, we have disclosed segment income forecasts, breakdown of recurring and non-recurring revenue for the Enterprise segment, and key performance indicators (KPIs) of important affiliate companies such as PayPay. For the fiscal year ended in March 2024, we also disclosed figures assuming the consolidation of PayPay from the beginning of the year for a better understanding of business performance on a year-on-year basis. We will continue to enhance information disclosure going forward. |

| Set ESG-related goals | In August 2022, we announced our commitment to achieving net-zero greenhouse gas emissions (including supply chain emissions) by 2050. In June 2023, we made the decision to expand this initiative to group companies. |

| Disclose your mid-to-long term goals | In May 2023, we announced our “Long-term Vision” and “Medium-term Management Plan (Fiscal year 2023 to 2025)” |

| Hold a briefing session or a similar event regarding next-generation social infrastructure | In January 2024, we held a “SuperPOD and Tokyo Fuchu Data Center Facility Tour” for sell-side analysts to deepen their understanding of our efforts to build next-generation social infrastructure. |

| Hold an ESG briefing session | In February 2024, we held our first ESG briefing session to further enhance understanding of our ESG initiatives. |

| External directors should comprise a majority of the Board of Directors to strengthen the corporate governance system | At the 38th Regular Shareholders' Meeting in June 2024, we appointed six independent external directors, which accounts for a majority (54.5%) of the Board of Directors, further strengthening our corporate governance system. |

Quiet period

The Company observes a quiet period of three weeks, which start on the same day of the week as the earnings results announcement, to prevent divulging earnings information and to ensure fairness. During this quiet period, the Company cannot comment on or answer any inquiries about earnings results. If any event that arises during a quiet period is subject to timely disclosure, however, the Company promptly discloses the information as appropriate.